35+ Payroll Calculator Pa

The formula the pay raise calculator uses is. Fill out our contact form or call 877 729-2661 to speak with Netchex sales and.

Pennsylvania Paycheck Calculator Smartasset

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. If you know the raise percentage and want to determine the new salary amount. This new employer rate typically applies for two to three. Heres a step-by-step guide to walk.

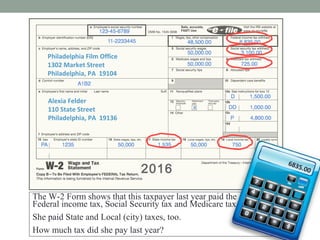

Medicare Tax is 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Use ADPs Pennsylvania Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This free easy to use payroll calculator will calculate your take home pay.

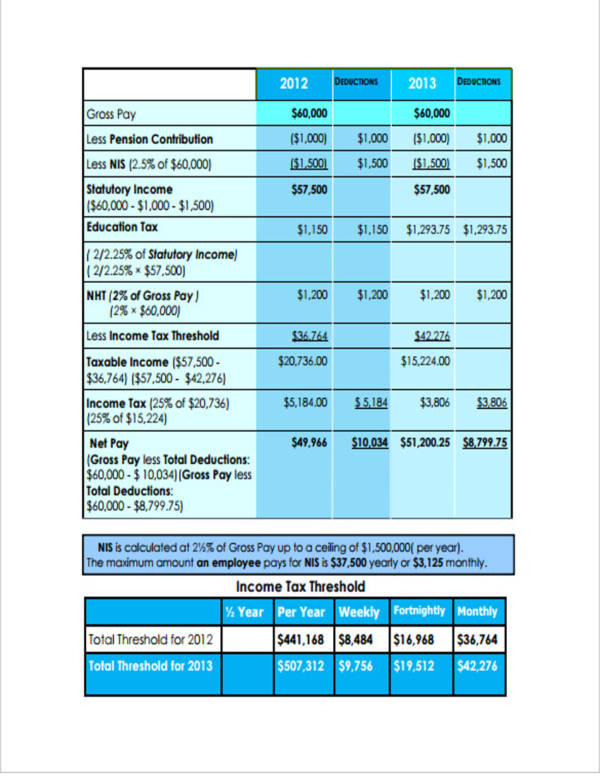

Important note on the salary paycheck calculator. All Services Backed by Tax Guarantee. The Pennsylvania Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and.

This calculator honours the ATO tax withholding formulas. New non-construction employers pay 36890 in 2022. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Calculating your Pennsylvania state income tax is similar to the steps we listed on our Federal paycheck. Ready for a live demo. Get Gusto the all-in-one HR platform for growing businesses.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Pennsylvania. Once that earning amount surpasses 200000 the rate is. The new W4 asks for a dollar amount.

If your total income will be. Heres how to calculate it. One intuitive service to manage HR payroll benefits.

New salary old salary old salary raise. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Enter an amount for dependentsThe old W4 used to ask for the number of dependents.

Just enter the wages tax withholdings and other information. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Calculate your Pennsylvania net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Ad Theres a new bar for HR. If youre in the construction field youll pay a 2022 UC rate of 102238.

Do you want to get more for your business with Payroll Benefits HR made easy. Supports hourly salary income and multiple pay frequencies. Office of the Budget Home Page.

Need help calculating paychecks. This method of calculating withholding PAYG income tax instalments can vary from the annual tax amounts.

How Many Taxes Are Taken From 560 A Week From 28 Hours Quora

Pennsylvania Hourly Paycheck Calculator Gusto

Free Pennsylvania Payroll Calculator 202 Pa Tax Rates Onpay

35 Goldman Sachs Aptitude Questions For Revision Unstop Formerly Dare2compete

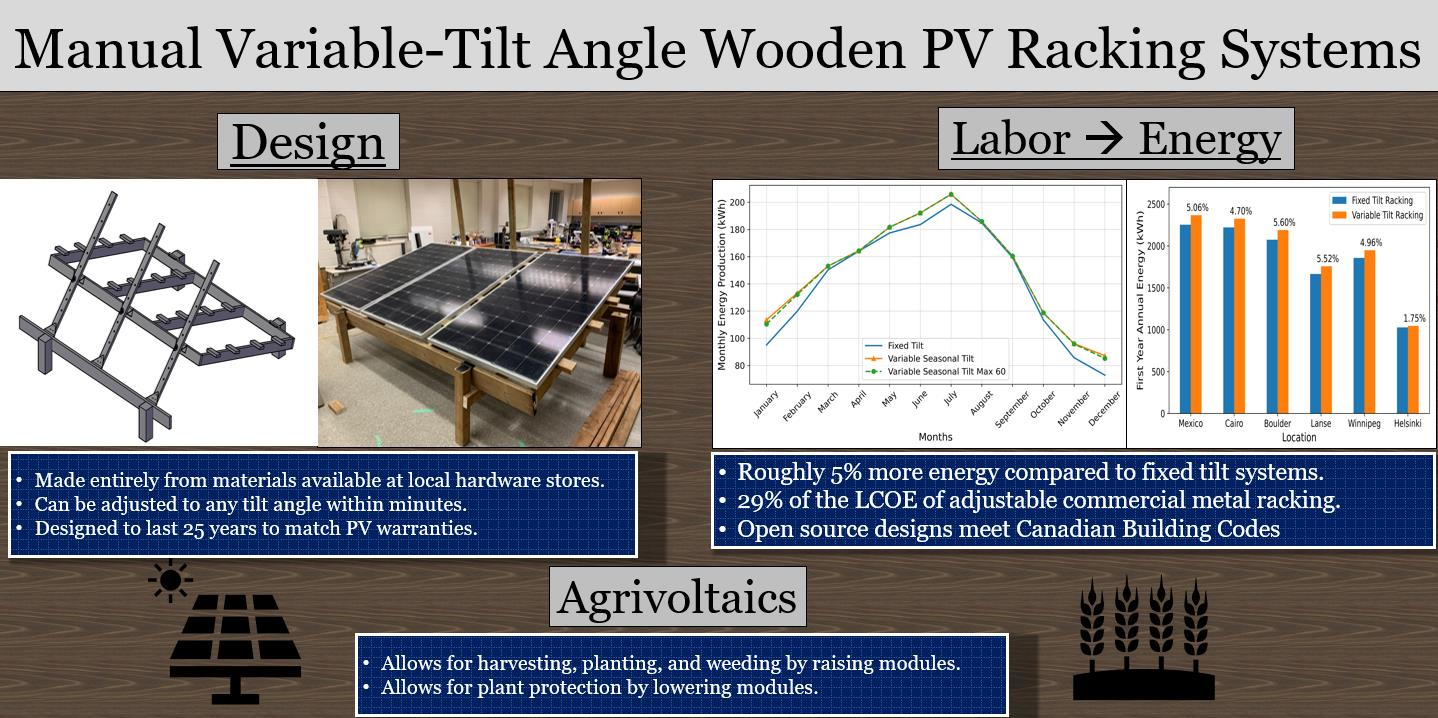

Designs Free Full Text Open Source Design And Economics Of Manual Variable Tilt Angle Diy Wood Based Solar Photovoltaic Racking System

35 Top Seo Agencies In The Usa Search Engine Optimization Agencies

Tax Day 16

J7kn Series Datasheet By Omron Automation And Safety Digi Key Electronics

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hi Fishes Can Someone Tell Me If Below Offer Fro Fishbowl

Workers Compensation Rates Explained 2020 Workers Comp Rates

Understanding Your Paycheck Moneyunder30

Tax Services Resume Samples Velvet Jobs

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

L Oreal Paris Cream Anti Fine Lines And Whitening 30 Age 50g Box Amazon In Beauty

How Much Money In Taxes Must Mlb Players Pay Quora

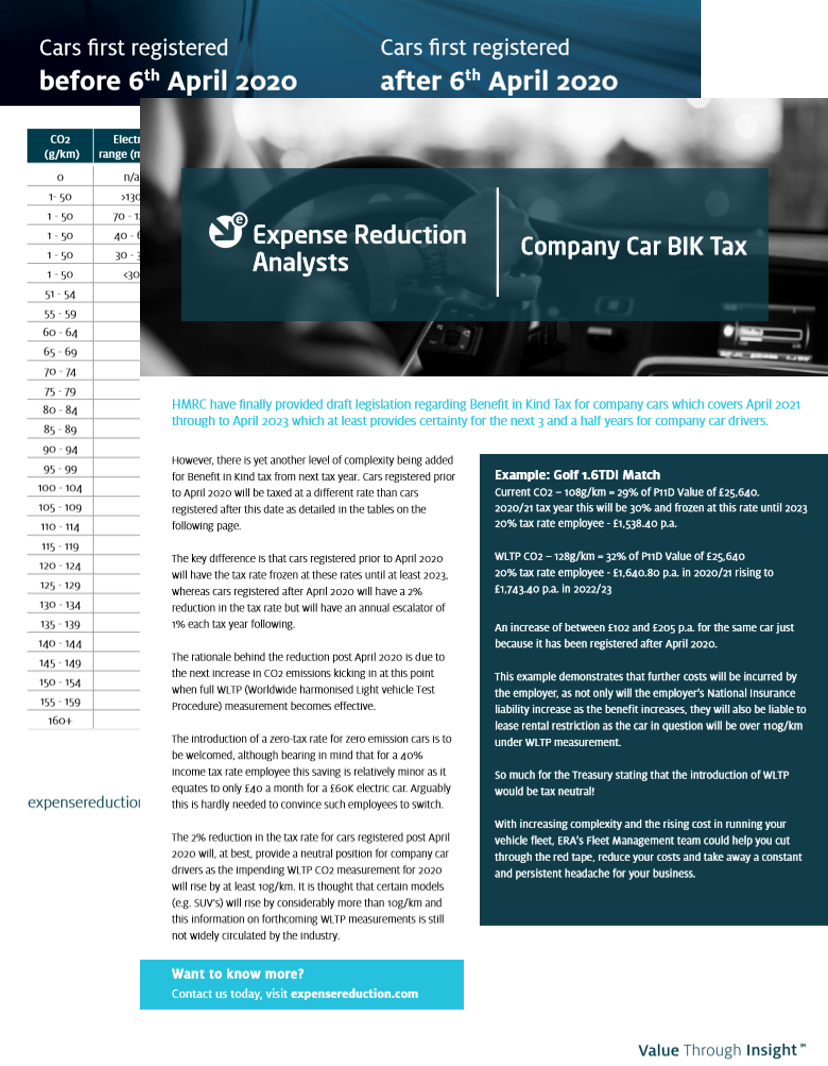

Benefit In Kind Bik Company Car Tax Guide And Calculator Expense Reduction Analysts