Real estate depreciation tax deduction calculator

What is the depreciation rate for real estate. It provides a couple different methods of depreciation.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

To use this method the following.

. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. First one can choose the. You must own the property not be renting or borrowing.

Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. In this case you must calculate the depreciation deduction for the later year. This is the first Calculator to draw on real properties to determine an accurate estimate.

All home tax records like mortgage interest real estate taxes any repairs and improvements. According to the IRS the depreciation rate is 3636 each year. This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life.

Explore Fawn Creek Township real estate statistics and housing costs. Your depreciation deduction is 8000 calculated as 220000 divided by 275 years. As you probably know depreciation is a tax deduction that reflects the costs of owning and improving a property.

Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual. Depreciation Calculator Depreciation Calculator Per the IRS you are allowed an annual tax. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

This is derived from 25000 in rental. The recovery period varies as per the method of computing depreciation. To take a deduction for depreciation on a rental property the property must meet specific criteria.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click. But with the depreciation write-off aka the number 1 write-off for real estate investors you now only have to pay tax on 6818. This limit is reduced by the amount by which the cost of.

The IRS considers the useful life of a rental property to be. D i C R i Where Di is the depreciation in year i C is the original purchase price or. According to the IRS.

It allows you to figure out the likely tax depreciation deduction on your next investment property. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

Even though you get to keep the entire 9600 because of depreciation you only pay. Depreciation Calculator Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. Section 179 deduction dollar limits.

This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the.

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator And Definition Retipster

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Rules Schedule Recapture

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Real Estate Depreciation Meaning Examples Calculations

How To Calculate Depreciation On Rental Property

How To Use Rental Property Depreciation To Your Advantage

Macrs Depreciation Calculator With Formula Nerd Counter

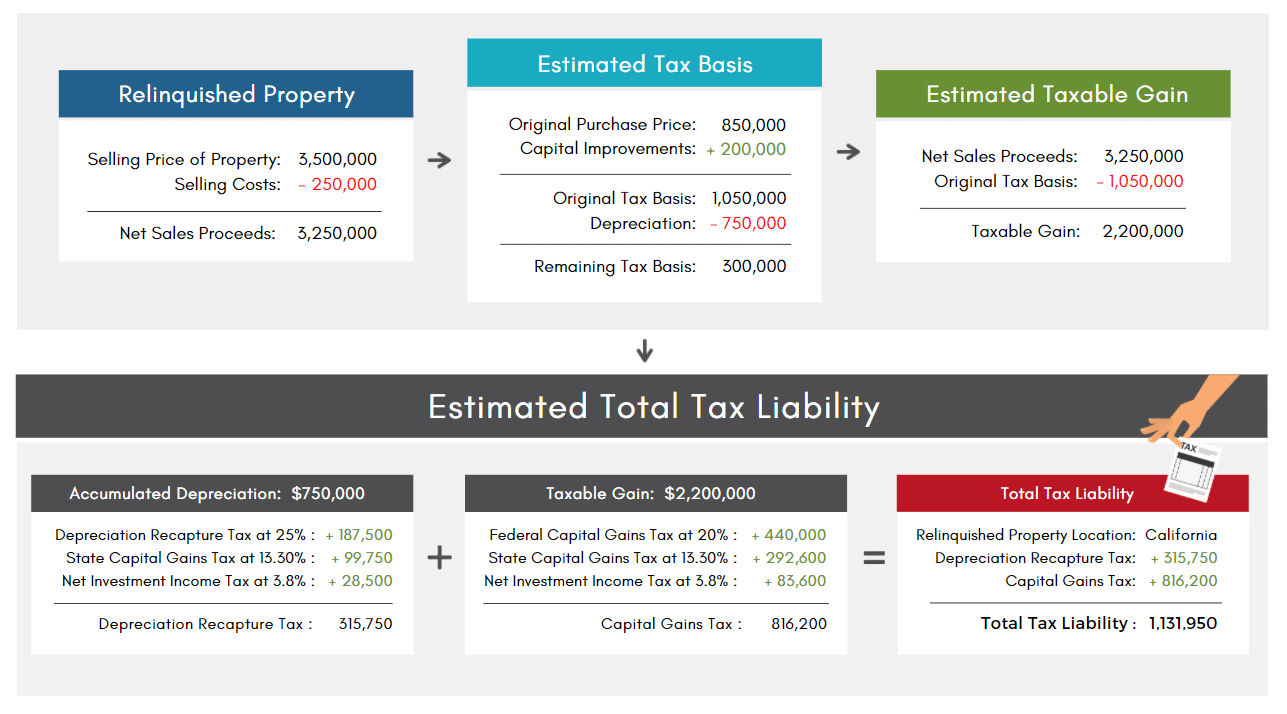

Selling Your Investment Property How To Calculate Your Tax Liability

Depreciation Tax Shield Formula And Calculator Excel Template

Macrs Depreciation Calculator Irs Publication 946

Rental Property Depreciation Rules Schedule Recapture

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Macrs Depreciation Calculator Straight Line Double Declining